web-phoenix.ru

Gainers & Losers

How Do You Pawn Something

A pawn, in its simplest form, is a loan. You bring an item in, we determine the value of the item, and offer you a cash loan on the spot. What is the process of pawning like? How long does it take? · You bring in or send an item by post to pawnbroker. · The pawnbroker will value your asset and make. In most cases, however, pawning means that an item is being held as collateral for a loan given to the borrower. Each state has varying rules and guidelines for. A pawnshop owner makes a loan to a customer who turns over the custody of an item that acts as collateral for the loan. Because the risk of loan default is high. A good appraiser will still be able to determine whether an item is authentic or a fake. However, keep in mind that not all pawn shops offer on-the-spot. When someone goes to a pawn shop, they may be able to secure a loan at a lower interest rate because they have an item that can use as collateral. For example. pawn Add to list Share To pawn something is to use it as collateral when you're borrowing money. When you pawn a necklace at a pawn shop, you get cash in. ePawn gives fast cash on anything of value! We are the industry's leader in giving quick pawns on redeemable items. ePawn is Atlanta's largest independent and. When you pawn an item, you are taking out a loan using your valuable as collateral. The pawnbroker will agree to give you a certain amount of cash and hold your. A pawn, in its simplest form, is a loan. You bring an item in, we determine the value of the item, and offer you a cash loan on the spot. What is the process of pawning like? How long does it take? · You bring in or send an item by post to pawnbroker. · The pawnbroker will value your asset and make. In most cases, however, pawning means that an item is being held as collateral for a loan given to the borrower. Each state has varying rules and guidelines for. A pawnshop owner makes a loan to a customer who turns over the custody of an item that acts as collateral for the loan. Because the risk of loan default is high. A good appraiser will still be able to determine whether an item is authentic or a fake. However, keep in mind that not all pawn shops offer on-the-spot. When someone goes to a pawn shop, they may be able to secure a loan at a lower interest rate because they have an item that can use as collateral. For example. pawn Add to list Share To pawn something is to use it as collateral when you're borrowing money. When you pawn a necklace at a pawn shop, you get cash in. ePawn gives fast cash on anything of value! We are the industry's leader in giving quick pawns on redeemable items. ePawn is Atlanta's largest independent and. When you pawn an item, you are taking out a loan using your valuable as collateral. The pawnbroker will agree to give you a certain amount of cash and hold your.

Pawning is a good choice when someone needs cash but does not want to lose ownership of an item. This includes getting a loan (AKA a pawn) based on the value of. Pawn loans are a simple form of collateral credit. Cash is given in exchange for an item that the pawnbroker - that's what we call the person who gives the loan. You bring in something you own, and if the pawnbroker is interested, he will offer you a loan. The pawnbroker then keeps your item until you repay the loan. The. About Pawn PAWN, n. something given as security for the repayment of money or the performance of a promise: state of being pledged. Banners What does the. How pawnbrokers work · The pawnbroker values your item (known as a 'pawn' or 'pledge'), so make sure you know its value before you take it in. · You and the. Pawn shop loans trade you cash for an item, which a lender keeps if you can't repay the loan. Learn how pawn shop loans work and discover safer. Want to sell your stuff? We are ready to buy any item! Jewelry, designers Many pawn shops out there will have unrealistic standards and. When you pawn an item, the pawnbroker will give you a ticket – this is your loan agreement. The ticket describes your pawn, the loan amount, fees, interest. Pawn shops use current market value to help them price their items or determine an item's value. When you select the personal property you want to consider. All pawn customers receive a detailed pawn ticket of the item pawned, amount borrowed, interest rate, maturity date, due date and amount due to retrieve the. You bring something in of value like gold or diamond jewelry or other valuables (listed Below) and the pawn broker will examine the item and determine the loan. When you decide to sell an item, you forfeit your ownership of it in exchange for cash. Pawning, however, does not mean you lose ownership. When you pawn an. Pawn shops typically allow you to either sell an item outright, or place the item in the temporary care of the store in exchange for a cash loan, which must be. A: A pawn is a collateral or personal asset loan. It's a loan that is given to a customer on an item the customer has that has current value. The item is held. An item that is in pawned at B&B Pawn can be picked up with the matching pawn slip or the ID of the person who did the original pawn. If the pawn slip is. The first step in acquiring a pawn loan is having collateral. Collaterals are valuables you pledge as security for repayment of a loan. Item appraisal and the amount offered are determined at the sole discretion of the pawnbroker. For example, a pawn transaction of an item appraised at. How do I make a pawn? · Does a pawn go against my credit score? · Do you take all electronics? · How long can I keep something in pawn? · What does “renewing” a. A pawn shop is a place where you can loan against an item for on the spot cash, then once the loan has been repaid with interest you get the item back. If you wish to take out a short-term personal loan, you have to provide an item of equal value to use as collateral. The pawnshop can sell that item if you fail.

Insurance By Age

Here's how to save on car insurance once you reach 75 and rates start to rise, including companies that offer special discounts. age rating applies to all non-group and small-group health insurance policies, whether sold in the Marketplace More. Health Insurance Coverage Type Breakdown: Age, Total Citizenship, Disability Status, Education, Family Income, Health Status, Limited English Proficiency. Through exclusive news stories, analysis, interviews and features, Insurance Age delivers the market intelligence brokers need to improve their business. The table below shows car insurance rates by age as a chart, and shows the the average annual rates for male and female drivers across a range of ages. How much does whole life insurance cost? A $, whole life insurance policy costs an average of $ per month for a year-old non-smoker in good health Did you know your car insurance rates drop significantly after you turn 25? After marriage? After buying a house? Discover savings for every decade. In , adults aged 18–44 were the most likely to be uninsured (%), compared with adults aged 45–64 (%) and children under age 18 years (%). Among. Drivers can usually expect to pay 12% to 20% less for car insurance coverage starting at age 25, since year-olds are no longer considered as high-risk as. Here's how to save on car insurance once you reach 75 and rates start to rise, including companies that offer special discounts. age rating applies to all non-group and small-group health insurance policies, whether sold in the Marketplace More. Health Insurance Coverage Type Breakdown: Age, Total Citizenship, Disability Status, Education, Family Income, Health Status, Limited English Proficiency. Through exclusive news stories, analysis, interviews and features, Insurance Age delivers the market intelligence brokers need to improve their business. The table below shows car insurance rates by age as a chart, and shows the the average annual rates for male and female drivers across a range of ages. How much does whole life insurance cost? A $, whole life insurance policy costs an average of $ per month for a year-old non-smoker in good health Did you know your car insurance rates drop significantly after you turn 25? After marriage? After buying a house? Discover savings for every decade. In , adults aged 18–44 were the most likely to be uninsured (%), compared with adults aged 45–64 (%) and children under age 18 years (%). Among. Drivers can usually expect to pay 12% to 20% less for car insurance coverage starting at age 25, since year-olds are no longer considered as high-risk as.

Average Health Insurance Rates by Age ; 40, , $ ; 41, , $ ; 42, , $ ; 43, , $ How much does whole life insurance cost? A $, whole life insurance policy costs an average of $ per month for a year-old non-smoker in good health It IS possible to still purchase long-term care insurance at age 75 (79 is generally the cut off). BUT it's going to be highly dependent on your current. In most cases, this is until age assuming they have a good driving record. Check with your insurance company to find out when your teen driver's rates are. Term life insurance rates by age ; Female, 50, $, $ ; Male, 55, $, $ At Progressive, the average premium per driver tends to decrease significantly from and then stabilize or decrease slightly from Your age – In general, mature drivers have fewer accidents than less experienced drivers, particularly teenagers. Insurers generally charge more if teenagers or. This is because as you age, your life expectancy goes down, and the likelihood of your insurer having to pay out your policy goes up. That's why it's wise to. In , adults aged 18–44 were the most likely to be uninsured (%), compared with adults aged 45–64 (%) and children under age 18 years (%). Among. Yes, 25 years old marks the first benchmark for a major decrease in car insurance premiums. While car insurance begins decreasing at age 17 and steadily. Age is one of the biggest factors in your life insurance premium. Bankrate explains. Impact of Age on Life Insurance Rates ; Male, 45, $, $, $ ; Male, 55, $, $, $ This means the Basic premium rate is the same for each enrollee in the group policy, regardless of age or health status. As such, younger employees may pay a. The “Age 29” law permits eligible young adults through the age of 29 to continue or obtain coverage through a parent's group policy. Insurers will notify. Your age – In general, mature drivers have fewer accidents than less experienced drivers, particularly teenagers. Insurers generally charge more if teenagers or. Typically, the premium amount increases, on average, about 8% to 10% for every year of age; it can be as low as 5% annually if your 40s, and as high as 12%. The “Age 29” law permits eligible young adults through the age of 29 to continue or obtain coverage through a parent's group policy. Insurers will notify. At age 50 or older, term life will generally be the most affordable option for getting the death benefit needed to help ensure your family is provided for. 2. Let's learn about how life insurance rates are calculated in general and provide a quick guide about how life insurance rates can differ by age. The cost of a car insurance policy may change over time with factors like your age, how many years you've been driving and your driving record.

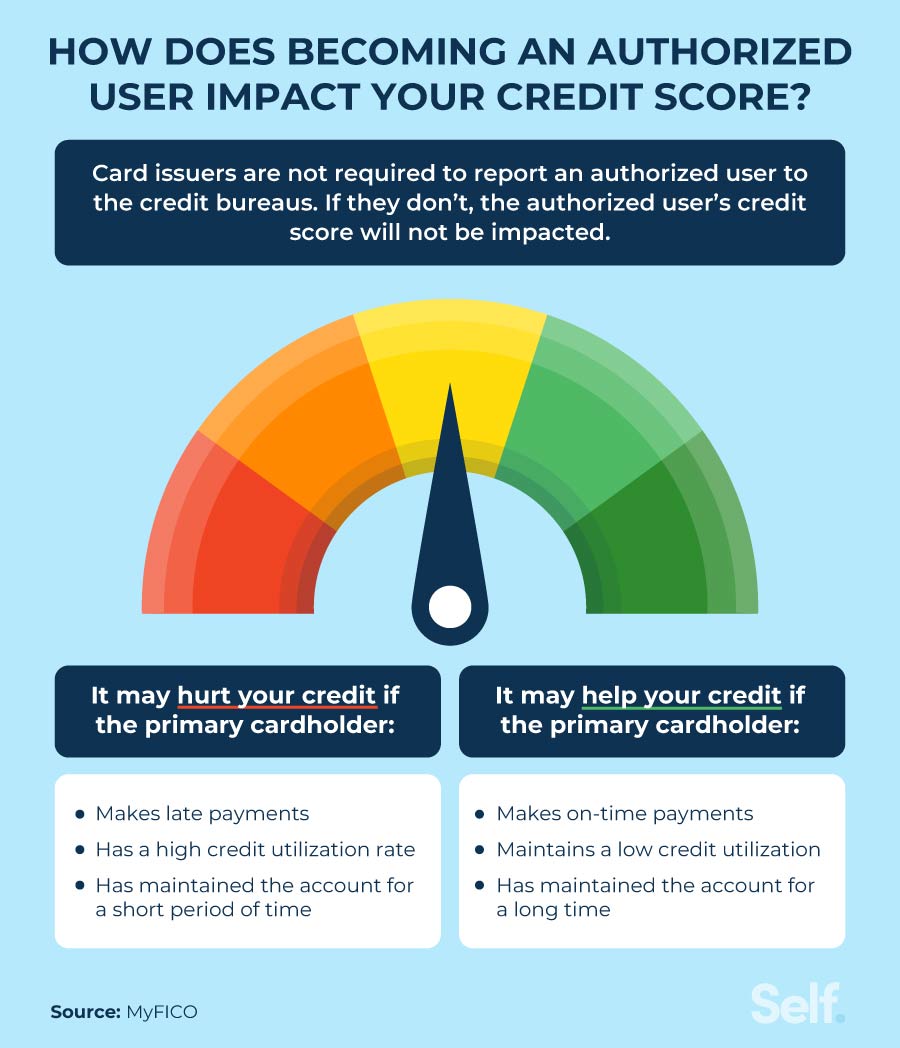

Care Credit Add An Authorized User

Also, an Authorized User can be added to your account by calling our Customer Care Center at () Conclusion. Whether you're in need of a routine. How do I add an authorized user to my card?Expand. Sign on to the Credit Card Service Center and select Add Authorized Users to Your Account under Account. Yes, just as a normal credit card, the owner can use it on what they choose. So, paying for your medical procedure is possible. But, with your. Care accepts CareCredit, a third party medical expense credit card. The CareCredit and have another person added to their card as an authorized user. entered into by the actual Cardholder or an authorized user of the Qualified Card). (xii) The transaction was submitted to Bank more than thirty (30) days. Once you've reached an agreement, the primary cardholder must authorize the credit card company to add you to their account. They can do so via telephone with. CareCredit openly permits and encourages the account holder to use the card to finance different treatments and procedures that may not even be theirs. The cardholder can call CareCredit during their business hours and identify the name of the person that will picking up the pet, and request that they be added. Launch the CareCredit Integrated Hosted Solution. Click Apply, then under “Submit a New Application”, select “Send Application to Device”. Enter/verify the data. Also, an Authorized User can be added to your account by calling our Customer Care Center at () Conclusion. Whether you're in need of a routine. How do I add an authorized user to my card?Expand. Sign on to the Credit Card Service Center and select Add Authorized Users to Your Account under Account. Yes, just as a normal credit card, the owner can use it on what they choose. So, paying for your medical procedure is possible. But, with your. Care accepts CareCredit, a third party medical expense credit card. The CareCredit and have another person added to their card as an authorized user. entered into by the actual Cardholder or an authorized user of the Qualified Card). (xii) The transaction was submitted to Bank more than thirty (30) days. Once you've reached an agreement, the primary cardholder must authorize the credit card company to add you to their account. They can do so via telephone with. CareCredit openly permits and encourages the account holder to use the card to finance different treatments and procedures that may not even be theirs. The cardholder can call CareCredit during their business hours and identify the name of the person that will picking up the pet, and request that they be added. Launch the CareCredit Integrated Hosted Solution. Click Apply, then under “Submit a New Application”, select “Send Application to Device”. Enter/verify the data.

For upgraded CareCredit credit cardholders: Once your CareCredit Rewards Mastercard is activated, your current CareCredit credit card will be closed. What is CareCredit all about? This User Guide explains the details of your CareCredit account so you can get the most out of your credit card. CareCredit is. Care accepts CareCredit, a third party medical expense credit card. The CareCredit and have another person added to their card as an authorized user. Go to Account Profile menu and select Add Authorized Users. How do I remove an Authorized User from my account? Use the Citi online process to remove an. Clients can add authorized users to the account, which gives them the ability to use the account for medical expenses, by calling CareCredit at or. Tiffany Hubbard he can add you as an authorized user and you'll get your own card. Otherwise,he'll have to be with you for you to use the card. How do I add an authorized user to my card?Expand. Sign on to the Credit Card Service Center and select Add Authorized Users to Your Account under Account. Use the Log In button to find your account login portal. Credit Card FAQs Synchrony Car Care™ credit card; Synchrony HOME™ Credit Card; SatisFi. You agree that if you apply for or use online servicing for an Account CareCredit credit card, and standard account terms will apply to such purchases. How do I add an authorized user to my credit card? · From the account dashboard, select the Menu in the upper left corner, then Manage cards. · Select Add. AUTHORIZED USER/JOINT ACCOUNT. If you ask us to send a credit card to another person that you want to let use your account, you will be responsible for all. Looking to become a CareCredit provider? Find answers to the most frequently asked questions about CareCredit's financing solution. add an authorized user to their account. It's a common arrangement among Continue your wellness journey by downloading the CareCredit Mobile App to manage. Act, (2) you or an authorized user uses the account, and (3) we extend Regular account terms apply to non-promotional purchases. For new accounts. Care Credit. Photo of happy woman with quote. Akasha now accepts CareCredit you can add authorized user to account call () ; 30 second. Authorized users don't have the same abilities as a primary cardholder, so they won't be able to increase the credit line, add more authorized users or redeem. Yes, the card holder can call Care Credit number to add Authorized User. They will need the new person's full name and social security number. Yes, the card holder can call Care Credit number to add Authorized User. They will need the new person's full name and social security number. Clients can add authorized users to the account, which gives them the ability to use the Clients can use their CareCredit credit card to pay any expense they. When making a payment in the app, you can choose from a bank account used previously or add a new one by tapping +Add Account. How do I pay an outstanding.

Sp 500 Stock Symbol

Find the latest S&P INDEX (^SPX) stock quote, history, news and other vital information to help you with your stock trading and investing. Fund Ticker RSP · CUSIP # V · ISIN USV · Intraday NAV RSPIV · Bloomberg Index Ticker SPXEWTR · Index Provider S&P Dow Jones Indices LLC · Management. The ticker symbol for the S&P index is ^GSPC. The series of letters represents the performance of the stocks listed on the S&P. View the full S&P Index (SPX) index overview including the latest stock market news, data and trading information. What's the secret to its durability? Stock ticker superimposed over cityscape S&P's yearly performance and own all of the index's stocks. And because. Brokerage commissions and ETF expenses will reduce returns. Intellectual Property Information: The S&P ® Index is a product of S&P Dow Jones Indices LLC or. SPX | A complete S&P Index index overview by MarketWatch. View stock market news, stock market data and trading information. List shows the holdings of the SPDR S&P ETF Trust (SPY). #, Company, Symbol, Weight, Price, Chg, % Chg. 1, Apple Inc. AAPL. The index is associated with many ticker symbols, including ^GSPC, INX, and $SPX, depending on market or website. The S&P is maintained by S&P Dow Jones. Find the latest S&P INDEX (^SPX) stock quote, history, news and other vital information to help you with your stock trading and investing. Fund Ticker RSP · CUSIP # V · ISIN USV · Intraday NAV RSPIV · Bloomberg Index Ticker SPXEWTR · Index Provider S&P Dow Jones Indices LLC · Management. The ticker symbol for the S&P index is ^GSPC. The series of letters represents the performance of the stocks listed on the S&P. View the full S&P Index (SPX) index overview including the latest stock market news, data and trading information. What's the secret to its durability? Stock ticker superimposed over cityscape S&P's yearly performance and own all of the index's stocks. And because. Brokerage commissions and ETF expenses will reduce returns. Intellectual Property Information: The S&P ® Index is a product of S&P Dow Jones Indices LLC or. SPX | A complete S&P Index index overview by MarketWatch. View stock market news, stock market data and trading information. List shows the holdings of the SPDR S&P ETF Trust (SPY). #, Company, Symbol, Weight, Price, Chg, % Chg. 1, Apple Inc. AAPL. The index is associated with many ticker symbols, including ^GSPC, INX, and $SPX, depending on market or website. The S&P is maintained by S&P Dow Jones.

Index performance for S&P INDEX (SPX) including value, chart, profile & other market data. S&P (SPX) · 1 Day · 1 Week · 1 Month · 3 Months · 6 Months · 1 Year · 5 years · Max. BNY Mellon Institutional S&P Stock Index Fund ; TICKER DSPIX ; Fund Code ; CUSIP K ; SHARE CLASS Class I. Base Data. Name, S&P ® Index. ISIN, USX Bloomberg Code, SPX Index. Currency, Pt. Price Data. Day High, 5, Pt. Day Low, 5, Pt. Close. The S&P is a stock market index maintained by S&P Dow Jones Indices. It comprises common stocks which are issued by large-cap companies traded. Instrument Name S&P Index Instrument Symbol (INX). Instrument Exchange INDEX/S&P ; Previous Close 5, ; YTD High 5, ; YTD Low 4, ; Volatility . Exchange · Exchange where its stocks are negociated. ; Symbol · Stock symbol ; Shortname · Company short name ; Longname · Company long name ; Sector · Sector where the. A list of all the stocks in the S&P stock index, which is an index of the top biggest companies listed on stock exchanges in the United States. Get S&P INDEX .SPX) real-time stock quotes, news, price and financial information from Reuters to inform your trading and investments. Schwab S&P Index Fund Type: Mutual Funds Symbol: SWPPX Total Expense Ratio: % Summary Objective The fund's goal is to track the total return of the S&. Bloomberg Ticker: SPX. The S&P ® is widely regarded as the best single gauge of large-cap U.S. equities. The index includes leading companies and covers. Find the latest information on S&P (SPX), including data, charts, related news, and more from web-phoenix.ru Bloomberg Ticker: SP5T5 · Documents · Index Classification · News & Announcements. Realtime Prices for S&P Stocks ; Arthur J. Gallagher, %. ; Assurant, %. View data of the S&P , an index of the stocks of leading companies in the US economy, which provides a gauge of the U.S. equity market. Key facts. IOV ticker symbol. web-phoenix.ru CUSIP. Management style. Index. Asset class. Domestic Stock - General. Category. Large Blend. Inception date. The iShares Core S&P ETF seeks to track the investment results of an index composed of large-capitalization U.S. equities. The "S&P ®" is a product of S&P Dow Jones Indices LLC and its affiliates and has been licensed for use by ProShares. "S&P®" is a registered trademark of. Standard and Poor's Index is a capitalization-weighted stock market index measuring the performance of large publicly traded companies in the United. S&P Index ($SPX) The information below reflects the ETF components for S&P SPDR (SPY). Percentage of S&P Stocks Above Moving Average. Please wait.

Top Ways To Invest Money

Perhaps the most common are stocks, bonds, and ETFs/mutual funds. Other types of investments to consider are real estate, CDs, annuities, cryptocurrencies. If you are looking for a very easy, reasonably safe way to invest your money I would recommend you to open a Stock Account with your bank and. Having a small budget shouldn't keep you from investing in your financial future. Here are smart ways to invest your dollars and grow your nest egg. Charles Schwab offers investment products and services, including brokerage and retirement accounts, online trading and more. Our articles can help you learn more about investing - from how to get started to the different ways to invest. What's the best way to put money aside to. Fund your account through transfers and rollovers. Explore ways to move cash, transfer investments and roll over assets into your J.P. Morgan investment account. 1. Build an emergency fund · 2. Pay down debt · 3. Put it in a retirement plan · 4. Open a certificate of deposit (CD) · 5. Invest in money market funds · 6. Buy. Top 10 Tips for First time investors · 1. Establish a Plan · 2. Understand Risk · 3. Be Tax Efficient from the Start · 4. Diversify · 5. Don't chase tips · 6. Invest. Bond Funds: Bonds are known for their stability and regular interest payments. Bond funds spread your risk across many bonds, offering a. Perhaps the most common are stocks, bonds, and ETFs/mutual funds. Other types of investments to consider are real estate, CDs, annuities, cryptocurrencies. If you are looking for a very easy, reasonably safe way to invest your money I would recommend you to open a Stock Account with your bank and. Having a small budget shouldn't keep you from investing in your financial future. Here are smart ways to invest your dollars and grow your nest egg. Charles Schwab offers investment products and services, including brokerage and retirement accounts, online trading and more. Our articles can help you learn more about investing - from how to get started to the different ways to invest. What's the best way to put money aside to. Fund your account through transfers and rollovers. Explore ways to move cash, transfer investments and roll over assets into your J.P. Morgan investment account. 1. Build an emergency fund · 2. Pay down debt · 3. Put it in a retirement plan · 4. Open a certificate of deposit (CD) · 5. Invest in money market funds · 6. Buy. Top 10 Tips for First time investors · 1. Establish a Plan · 2. Understand Risk · 3. Be Tax Efficient from the Start · 4. Diversify · 5. Don't chase tips · 6. Invest. Bond Funds: Bonds are known for their stability and regular interest payments. Bond funds spread your risk across many bonds, offering a.

2. Determine goals Setting goals will give your investing a purpose and provide a finish line for your hard work. To determine your goals, spend some time. Invest for income If you want to create income from investing one option is to choose investments that provide regular payments. For instance, shares may pay. Mutual funds and ETFs are often managed by professionals and come in many different forms, so you can pick one that meets your objectives and risk tolerance. It's the best way to invest in the general market without taking on the risk that comes with individual stocks or bonds. ETFs are especially important with. The best way to invest your money is the way that works best for you. To There are many ways you can invest money, including stocks, bonds, mutual. Tips for Successful Investing · 1. Set investment goals. Identify your most important short-, medium and long-term financial goals. · 2. Know your investment time. Securities, such as stocks or mutual funds. These investment products are available through investment accounts with a broker-dealer. Investing, by nature, involves risk. That means you could lose money on your investment. But generally, the higher the risk, the higher the potential return of. It's one of the best ways to meet your financial goals. 3 keys to investing All investing is subject to risk, including the possible loss of the money you. shares - you buy a stake in a company · cash – the savings you put in a bank or building society account · property – you invest in a physical building, whether. 7 Tips for Spending Money Wisely · How to Become an Investor · What is Best Way to Invest 10K · WorkshopToolbox · Subscription DisclosurePrivacy Policy. Best ways to invest your money · Insurance plans. These instruments are excellent for young beginners with a steady source of income. · Mutual funds. Mutual. Unlike deposits at FDIC-insured banks and NCUA-insured credit unions, the money you invest in securities typically is not federally insured. ways to lessen. 5 types of low-risk investments · 1. Treasury bills, Treasury notes and TIPs · 2. Fixed annuities · 3. Money market funds · 4. Corporate bonds · 5. Series I savings. But if things go badly, you could lose all of the money you invested. And Should you invest? Tips on getting your immediate finances in order before you. If you are looking for a very easy, reasonably safe way to invest your money I would recommend you to open a Stock Account with your bank and. Investing is an effective way to put your money to work and potentially build wealth. Smart investing may allow your money to outpace inflation and increase in. Fixed-rate savings bonds are among the surest ways to see growth on your savings – in return for locking away your money for a set amount of time, banks will. investments. The way you divide your money among these groups of investments is called asset allocation. You want an asset allocation that is diversified or. It takes planning and commitment and, yes, money. Facts. ▫ Only about half Put your savings in different types of investments. By diversifying this.

Benefit Of Budgeting

A Budget is an organization's operational plan for the future. It illustrates a firm's estimation of expected revenue and expenses as well as the inflow of. A budget can help a business anticipate and plan for potential financial challenges. This can reduce the risk of financial difficulties in the future. What are the benefits of budgeting · 1. Gives you control over your money · 2. Helps you focus on your financial goals · 3. Keeps you on top of what you're. Financial Discipline: Budgeting instills financial discipline by providing a structured framework for managing income and expenses. It. Which one of the following is a primary benefit of budgeting? A) It eliminates potential problems so that managers do not need to be concerned that things may. Budgeting allows you to see exactly where your money is going, and identify areas where you can cut back on unnecessary expenses. This helps you. Advantages of budgeting · manage your money effectively · allocate appropriate resources to projects · monitor performance · meet your objectives · improve. Creating a budget allows students more financial freedom because they are aware of how much money they can spend on certain things upfront. Budgeting takes away. Get a clear picture of things: Creating a budget and tracking your progress provides you with a transparent view of your finances and spending behavior. Part of. A Budget is an organization's operational plan for the future. It illustrates a firm's estimation of expected revenue and expenses as well as the inflow of. A budget can help a business anticipate and plan for potential financial challenges. This can reduce the risk of financial difficulties in the future. What are the benefits of budgeting · 1. Gives you control over your money · 2. Helps you focus on your financial goals · 3. Keeps you on top of what you're. Financial Discipline: Budgeting instills financial discipline by providing a structured framework for managing income and expenses. It. Which one of the following is a primary benefit of budgeting? A) It eliminates potential problems so that managers do not need to be concerned that things may. Budgeting allows you to see exactly where your money is going, and identify areas where you can cut back on unnecessary expenses. This helps you. Advantages of budgeting · manage your money effectively · allocate appropriate resources to projects · monitor performance · meet your objectives · improve. Creating a budget allows students more financial freedom because they are aware of how much money they can spend on certain things upfront. Budgeting takes away. Get a clear picture of things: Creating a budget and tracking your progress provides you with a transparent view of your finances and spending behavior. Part of.

Budgeting - What is the benefit of budgeting? With the help of a budget, you can keep track of your spending, save for investments, and pay off your debt. 7 Advantages of Budgeting · 1. It Helps the Natural Savers to Spend – the Natural Spenders to Save · 2. For Natural Savers Like Me, a Budget Is Liberating! · 3. Budgeting is a crucial part of financial planning. It helps you keep track of your expenses, savings, and investments. By having a budget, you can better manage. This month we'll be diving into two new types of budgets: the no-budget plan and the time-based budget. Budgets allow students to analyze necessary expenses and plan for unexpected costs. A responsible borrower will limit unnecessary expenses and develop. Benefits Of Budgeting & Forecasting · Understanding what the numbers mean and what decisions need to be made. · Setting company goals and monitoring progress to. (Location: HCM\UT BUDGETS\REPORTS\ESTIMATED. BENEFITS ENCUM RPT FOR BENEFIT CALCULATION - note: you must use as of date. 09/01/). Drawing up a budget of all your household income and outgoings is a must if you want to make sure you can pay all your bills and manage until the end of the. Interest-free loans from the government for some people on benefits: how to apply, check if you're eligible. What are the benefits of budgeting? · 3. Helps in achieving your financial goals. As we've already mentioned, setting a budget can help you achieve your goals. Budgeting is a powerful process that can help you develop a financial plan and build financial capability and empowerment. A budget is a financial plan that outlines an individual's or organisation's income and expenses over a specific period. Benefits of budgeting include providing "guardrails" (ie, designated limits) for spending, achieving financial goals (if savings is included as a fixed ". Budget is the plan prepared for an individual, business or any project which expends money to achieve the goal. Budgeting is the process of creating a financial plan for your business, which can help you keep track of your income and expenses. There are numerous benefits of budgeting. Without a budget, it's all too easy to underestimate your expenses and diminish cash flow. The primary benefit of budgeting is that it helps you to take control of your finances. By creating a plan for your income and expenses, you're able to see. A budget is a plan you write down to decide how you will spend your money each month. A budget helps you make sure you will have enough money every month. A budget can assist you in determining your long-term objectives and setting you on the route to achieving them. Having a set of criteria or a plan for. Award-winning benefits calculator. Check benefits eligibility to ensure household income is maximised in cost of living crisis.

What Is The Best Investment To Hedge Against Inflation

According to historical data, stocks of companies that can raise prices for their products are actually the best hedges against inflation. They. Market insights. Stay ahead of the markets with insights from our strategists and portfolio managers. Uncover the latest on the global economy. 1: Invest in Treasury Bonds · 2: Purchase Gold and Precious Metals · 3: Fund a High-Yield Savings Account · 4: Invest in the Stock Market · 5: Buy Alternative. An inflation hedge is an investment intended to protect the investor against—hedge—a decrease in the purchasing power of money—inflation. However, in a scenario where inflationary pressure remains elevated and economic growth stalls, real estate investment trusts (REITs) include a number of. While stocks, bonds, and cash lose their purchasing power as inflation rises, investing in self-storage real estate may be the perfect inflation hedge. Self-. Traditionally, investments such as gold and real estate are preferred as a good hedge against inflation. Stocks hedge against inflation in two main. The stock market is a wonderful hedge against inflation for a few reasons. Since , the U.S. stock market is up % per year while inflation has averaged 3%. Adding certain asset classes, such as commodities or real estate, to a well-diversified portfolio of stocks and bonds can help buffer against inflation. According to historical data, stocks of companies that can raise prices for their products are actually the best hedges against inflation. They. Market insights. Stay ahead of the markets with insights from our strategists and portfolio managers. Uncover the latest on the global economy. 1: Invest in Treasury Bonds · 2: Purchase Gold and Precious Metals · 3: Fund a High-Yield Savings Account · 4: Invest in the Stock Market · 5: Buy Alternative. An inflation hedge is an investment intended to protect the investor against—hedge—a decrease in the purchasing power of money—inflation. However, in a scenario where inflationary pressure remains elevated and economic growth stalls, real estate investment trusts (REITs) include a number of. While stocks, bonds, and cash lose their purchasing power as inflation rises, investing in self-storage real estate may be the perfect inflation hedge. Self-. Traditionally, investments such as gold and real estate are preferred as a good hedge against inflation. Stocks hedge against inflation in two main. The stock market is a wonderful hedge against inflation for a few reasons. Since , the U.S. stock market is up % per year while inflation has averaged 3%. Adding certain asset classes, such as commodities or real estate, to a well-diversified portfolio of stocks and bonds can help buffer against inflation.

At first glance, gold might not seem to be that great of an inflation hedge these days. After gaining some ground from about $1, per ounce at the start. Real estate is also a good hedge against inflation. and sometimes real estate inflation can even work to your advantage. Imagine there is a money supply of a. Many investors believe gold can be an excellent hedge against inflation, as it holds its value while currencies decrease in value. However, according to my. Investing in precious metals, commodities, and REITs are all popular options for hedging against inflation. However, the more popular these options are, the. Traditionally, investments such as gold and real estate are preferred as a good hedge against inflation. However, some investors still prefer investing in. Every investor wants some level of stable investments to round out their diversified investment portfolio. Stocks and bonds can fluctuate widely, so having a. When limited only to financial assets, the energy equity sector provides the best potential inflation hedge, with positive inflation-adjusted return potential. REITs offer an inflationary hedge for the same reasons as conventional real estate investments. However, with REITs, the barriers to entry are significantly. Precious metals ETFs, such as those that track the price of gold or silver, can be a potential hedge against inflation. For example, gold is seen as a safe-. “TIPS are by far the best inflation hedge for the average investor,” she tells Select. TIPS bonds pay interest twice a year at a fixed rate, and they are issued. 12 Best Investments To Hedge Against Inflation · 1. Fine Wine · 2. Gold · 3. Commodities · 4. Real Estate · 5. Stocks · 6. TIPS (Treasury Inflation Protected. Best Inflation-Proof Investments for ; Advance Auto Parts (AAP %) ; Walmart (WMT %) ; Berkshire Hathaway (BRK.A %)(; The biggest beneficiaries of. Which assets should I consider as inflation hedges? · Treasury inflation-protected securities (TIPS) · Series I savings bonds · Floating rate bonds · Commodities. Real estate has been one of the most popular investment choices among global investors. Since the price of real estate usually rises along with inflation, it is. Gold. Investing in gold is often considered the go-to inflation-fighting move. It can't be printed out of thin air like fiat. Cash can sometimes be the best place for our money, and is certainly preferable to hold over bonds with inflation going up, but is rarely preferable overall. recommendations against an investor's current plan helps advisors prioritize Examining TIPS as investors hedge against inflation. How are investors. 7 Stocks That Are Good Inflation Investments · Mosaic Co. (MOS) · APA Corp. (APA) · Applied Materials Inc. (AMAT) · Halliburton Co. (HAL) · Advanced Micro Devices. good hedge against inflation”. But is it always? In this piece we summarise Inflation over different investment horizons. Property sector performance vs.

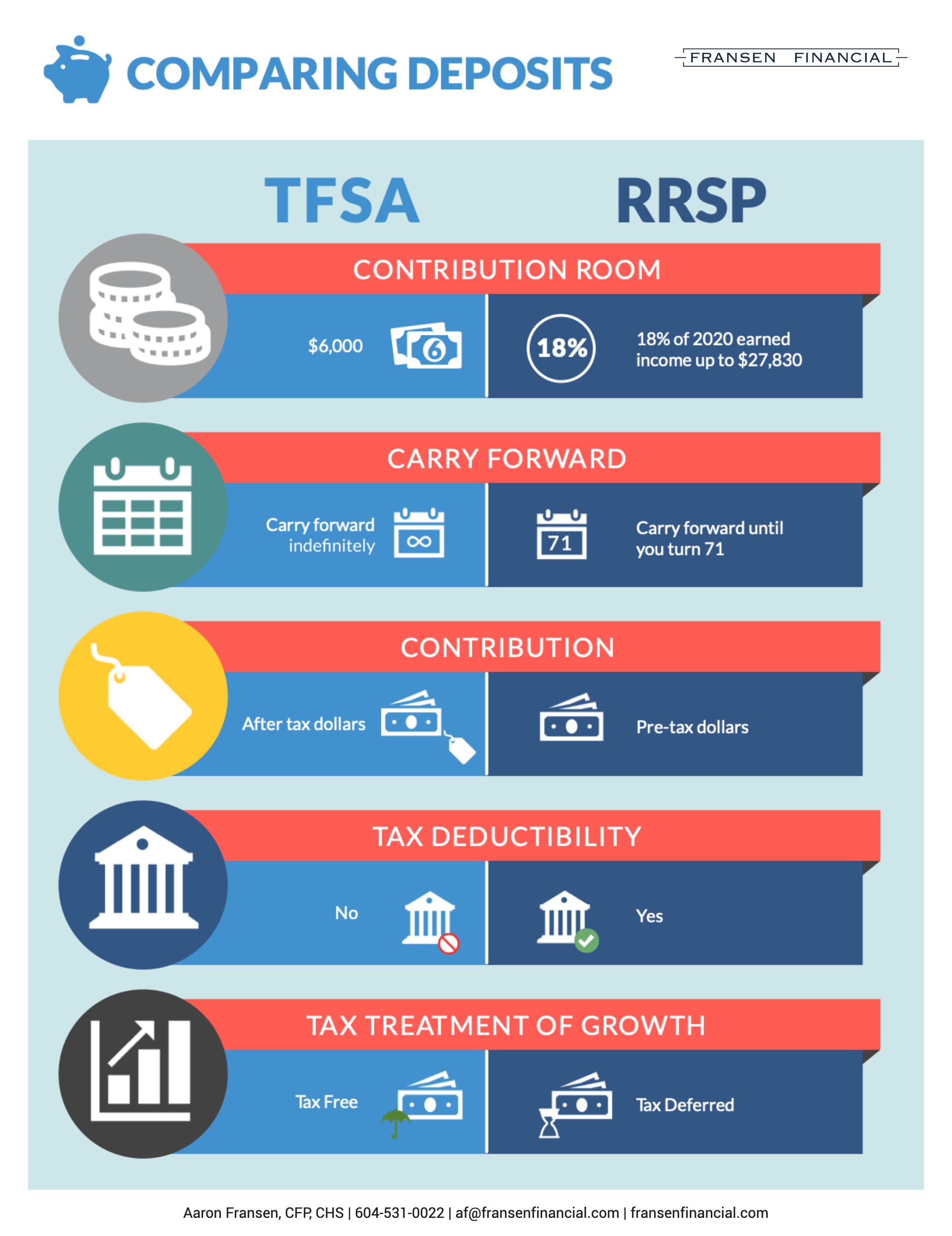

Tfsa Intrest Rate

Tax-Free Savings Account (TFSA) ; Redeemable Semi-Annual Compound Interest GICs · Prior redemption rate: %; Minimum deposit: $ ; Non-Redeemable Annual. Watch your money grow faster, because you're not paying pesky taxes on the interest earned. Our latest & greatest rate. Designed to meet your everyday. High Interest TFSA Savings Account – TD Canada Trust TFSA. Total Daily Closing Balance. Interest Rate. $0 to $ %. $1, to $4, We offer a high interest TFSA, a savings account with an interest rate of %. This way, you can enjoy all the tax advantages of a TFSA. You want to earn a higher rate of interest and have the freedom to access your funds if you need them. Term Length, 12 Months. Minimum Deposit, $1, TFSA GIC ; Non-Redeemable, Redeemable ; 12 months, %**, % ; 24 months, %, n/a ; 36 months, %, n/a ; 48 months, %, n/a. We adjusted the rate to remain between 1% and 15%. This is the increase in a year, as a percent of your original investment. See TD: GIC rates & TD Mutual Funds. Grow your money and save more without monthly fees. Interest is calculated on the daily closing balance and is paid into your TFSA monthly. Calculations are estimates only based on the current interest rate of %, which may change, and based on interest calculated daily and paid monthly, assuming. Tax-Free Savings Account (TFSA) ; Redeemable Semi-Annual Compound Interest GICs · Prior redemption rate: %; Minimum deposit: $ ; Non-Redeemable Annual. Watch your money grow faster, because you're not paying pesky taxes on the interest earned. Our latest & greatest rate. Designed to meet your everyday. High Interest TFSA Savings Account – TD Canada Trust TFSA. Total Daily Closing Balance. Interest Rate. $0 to $ %. $1, to $4, We offer a high interest TFSA, a savings account with an interest rate of %. This way, you can enjoy all the tax advantages of a TFSA. You want to earn a higher rate of interest and have the freedom to access your funds if you need them. Term Length, 12 Months. Minimum Deposit, $1, TFSA GIC ; Non-Redeemable, Redeemable ; 12 months, %**, % ; 24 months, %, n/a ; 36 months, %, n/a ; 48 months, %, n/a. We adjusted the rate to remain between 1% and 15%. This is the increase in a year, as a percent of your original investment. See TD: GIC rates & TD Mutual Funds. Grow your money and save more without monthly fees. Interest is calculated on the daily closing balance and is paid into your TFSA monthly. Calculations are estimates only based on the current interest rate of %, which may change, and based on interest calculated daily and paid monthly, assuming.

TFSA rates ; $K** and over, % ; month, Less than $K · % ; $K - $,, % ; $K** and over, % ; month, Less than $K · %. Non-Redeemable TFSAs. ; TFSA non-redeemable, 24 to less than 30 months, % ; TFSA non-redeemable, 30 to less than 36 months, % ; TFSA non-redeemable, 36 to. Interest rates including the add-on Absa Digital Bonus Rate ; R50 R74 %. %. % ; R 75 R99 %. %. %. At the same time, you invest another $6, into a non-registered account. If both accounts earn 5% interest per year (compounded annually), you'll make $ in. Most TFSA savings accounts earn interest, but the rate varies widely between banks and accounts. The best TFSA savings accounts in Canada currently pay %. What are the benefits of TFSAs? · Tax-free growth - you don't pay taxes on interest earned in your TFSA which helps you build your savings faster · Tax-free. You can hold cash in liquid high interest savings accounts, term See how your tax rate affects the growth of a TFSA vs an RRSP to help you choose. % promotional interest is for new deposits to Tax-Free Advantage Accounts. The promotional interest rate is made up of the regular posted variable annual. Designed to help you save money for a wide range of goals — not just retirement. You get competitive interest rates and there is no need to keep a minimum. tax free savings account (TFSA). Earn competitive, guaranteed interest rate and don't pay tax on any interest earned. Set your account to renew. Earn a competitive interest rate on your money as it grows, with no monthly account fee. Available in registered§ and non-registered plans. Accelerate your. TFSA Savings Account Tax-free make. None of the take. Open a TFSA to earn % * tax-free interest with flexible withdrawals and zero fees. Start saving more at a great rate of %1,2. Man on ladder building dollar sign. Motive® TFSA GIC. You. Get a limited-time special rate on the CIBC TFSA Tax Advantage Savings Account® and the CIBC RRSP Daily Interest Savings Account. Get started today. A TFSA is a government-registered account that allows you to grow your savings tax-free, whatever your annual income. You pay no tax on interest, income, or. Redeemable 1 year cashable TFSA GIC ; Full term - Redeemable anytime, % ; Early redemption (90 days or greater), % ; Early redemption (30 - 89 days), %. Here are the best interest rates being offered on TFSA high-interest savings from the major Canadian banks. Earn money tax-free with the best TFSA bank account. Enjoy the highest interest rates in Canada to build your wealth. Apply for an account today! Open a TFSA account with BMO today Low Interest RateLow fees, low interest; RewardsEarn rewards on every dollar. Rates and contribution limits Administrative or other fees in relation to a TFSA and any interest on money borrowed to contribute to a TFSA are not tax-.

How To Put Cash App Money In Bank Account

Cash App is the #1 finance app in the App Store. Pay anyone instantly. Save when you spend. Bank like you want to. Buy stocks or bitcoin with as little as. Tap on the Add Cash button on your Homepage. Claim your USD account number. Chipper Cash will issue you a virtual account number, routing number, bank name. Tap the Banking tab, which is located on the Home Screen. · Select the “Add Cash” option. · Enter the exact amount you want to transfer and tap “Add.”. Learn how to transfer money to another bank account · Create your profile · Choose where and how much · Enter who will get the money · Pick your payment option. Cash App is a popular consumer app in the US that allows customers to bank, invest, send, and receive money using their digital wallet. bank statement with. Hey there - you'll need to link a debit card if you're wanting to add funds to your Cash App balance. While you can transfer funds from your. Linking your bank account makes receiving money easier too. When you cash out, your payments deposit instantly into your bank account. Deposit paper money. Add Bank Account · Tap the Profile Icon on your Cash App home screen · Select Linked Banks · Tap Link Bank · Follow the prompts alt text *Before this option is. Bank the way you want—without all the fees. Advanced Security features protect your account. Get paid up to 2 days early with direct deposit. Cash App is the #1 finance app in the App Store. Pay anyone instantly. Save when you spend. Bank like you want to. Buy stocks or bitcoin with as little as. Tap on the Add Cash button on your Homepage. Claim your USD account number. Chipper Cash will issue you a virtual account number, routing number, bank name. Tap the Banking tab, which is located on the Home Screen. · Select the “Add Cash” option. · Enter the exact amount you want to transfer and tap “Add.”. Learn how to transfer money to another bank account · Create your profile · Choose where and how much · Enter who will get the money · Pick your payment option. Cash App is a popular consumer app in the US that allows customers to bank, invest, send, and receive money using their digital wallet. bank statement with. Hey there - you'll need to link a debit card if you're wanting to add funds to your Cash App balance. While you can transfer funds from your. Linking your bank account makes receiving money easier too. When you cash out, your payments deposit instantly into your bank account. Deposit paper money. Add Bank Account · Tap the Profile Icon on your Cash App home screen · Select Linked Banks · Tap Link Bank · Follow the prompts alt text *Before this option is. Bank the way you want—without all the fees. Advanced Security features protect your account. Get paid up to 2 days early with direct deposit.

Tap “Add,” then use Touch ID or enter your PIN to confirm. How to transfer money from Cash App to bank account? Tap the “Banking” tab on the Cash App home. The Samsung Pay Cash feature lets you add and send money directly through the Samsung Wallet app You can add funds from a bank account or from a credit card. Enter your debit card info to link your bank account to Cash App. Sending and receiving money is totally free and fast, and most payments are deposited directly to your bank account in minutes. Press Cash Out and choose an amount; Select Standard ( business days); Type “cashapp” in the search field; Press Add Manually; Enter your routing and account. Funds arrive in your bank account the next business day. Before you begin Learn more about Cash App direct deposit. Review transfer options. Square. Cash App may not allow you to transfer money or deposit funds into your bank account due to various reasons such as security concerns. For example, if you want to make a standard transfer from your Cash App balance to your linked bank account, it's free. Sending, receiving and adding money on. Cash App is the easy way to send, spend, save, and invest* your money. Download Cash App and create an account in minutes. SEND AND RECEIVE MONEY INSTANTLY. Move money or setup a future transfer within the Mobile Banking app or Online Banking. Transfers can be set up between your Bank of America accounts. Cash App is an online money transfer app. A Cash App user can deposit money into their account using another bank account. You can access your account on. Adding Cash · Launch Cash App · Tap the bank icon in the lower left corner to open the Banking tab · Tap the Add Cash button · Enter the amount of cash you want to. You can deposit paper money into your Cash App balance at participating retailers. Cash App charges a flat-rate $1 processing fee on each paper money deposit. Keep in mind that you can only have one bank account and one debit card connected to your Cash App account. **Direct deposit funds may be available for use. Cash App offers standard transfers to your bank account and Instant transfers to your linked debit card. Standard transfers are free and arrive within 1. Open the Cash App on your mobile device. · 2. Tap on the "Banking" tab located at the bottom of the screen. · 3. Select the bank account linked. Send money · Tap "Pay & Transfer" then "Zelle®," and "Send." · Select your recipient · Enter the amount and select your funding account. · Include an optional note. Scroll down to linked banks, select the debit card that your money is cashing out to, and then click replace card. Then enter the debit card for. Send money to friends and family no matter where they bank in the U.S., using the Bank of America Mobile Banking app with Zelle®.

Credit Card Buyout

Buyout Loan · Get an Easy Finance and transfer your loan to Finance House for a cheaper interest rate · Apply now, SMS “BUY” to or call · Click. Credit card companies issue credit to ease purchases and allow consumers to delay payment on items. Credit cards allow consumers to purchase items they may not. Credit Card Buyout Program at 0% Interest rate for the first 6 months: Now you can replace your credit card from any local bank with our ahli credit card. Credit is subject to approval. Certain restrictions and conditions apply. · Debt Consolidation: Debt consolidation combines multiple debts into a new loan with a. credit-cards-icon Credit Cards. Best Credit Cards · Balance Transfer Credit If the last option is the most appealing, you may be considering a lease buyout. A new car is an expensive purchase, so you may be wondering about all of your payment options. Most people opt for auto loan financing, as it doesn't. It is a facility offered by most banks and financial institutions in the UAE that gives consumers having pre- existing loans. Borrowers who have high credit scores, a strong payment history and an established relationship with their credit card provider will generally have a better. Features · Loans up to AED 5 million for UAE nationals and AED 2 million for expats · Interest rates from *% variable for Emiratis and *% variable for. Buyout Loan · Get an Easy Finance and transfer your loan to Finance House for a cheaper interest rate · Apply now, SMS “BUY” to or call · Click. Credit card companies issue credit to ease purchases and allow consumers to delay payment on items. Credit cards allow consumers to purchase items they may not. Credit Card Buyout Program at 0% Interest rate for the first 6 months: Now you can replace your credit card from any local bank with our ahli credit card. Credit is subject to approval. Certain restrictions and conditions apply. · Debt Consolidation: Debt consolidation combines multiple debts into a new loan with a. credit-cards-icon Credit Cards. Best Credit Cards · Balance Transfer Credit If the last option is the most appealing, you may be considering a lease buyout. A new car is an expensive purchase, so you may be wondering about all of your payment options. Most people opt for auto loan financing, as it doesn't. It is a facility offered by most banks and financial institutions in the UAE that gives consumers having pre- existing loans. Borrowers who have high credit scores, a strong payment history and an established relationship with their credit card provider will generally have a better. Features · Loans up to AED 5 million for UAE nationals and AED 2 million for expats · Interest rates from *% variable for Emiratis and *% variable for.

Many credit card issuers have special balance transfer offers to invite people to open cards with them. The offers might include months with a zero percent. With Buy Now, Pay Later, you can spread the cost of your debit card purchases over fixed monthly payments. Buyout Program · Boat Loans · RV Loans. Menu. New & Used Auto Loans · Lease Buyout Island Credit Mastercard – The One Card That Has It All. No Annual Fee. Capital One Financial Corporation is an American bank holding company founded on July 21, and specializing in credit cards, auto loans, banking. It is a facility offered by most banks and financial institutions in the UAE that gives consumers having pre- existing loans. Security, convenience, low rates, and no annual or balance transfer fees. Get a credit card that helps you do more. Our members love our great rates. What you can expect when you buyout your lease with Valley First Credit Union: · Avoid spending hours at a dealership and DMV · Finance your lease buyout with. Our No Foreign Transaction Fees benefit means we will rebate fees you are charged when using your Mastercard credit card to make a purchase from a merchant. Lower your interest rate · Consolidate debt from higher-rate loans and/or credit cards · Pay off debt faster · Switch to an account with better benefits. Earn % cashback on every purchase with your Irish Rewards credit card. Learn More About Credit Cards. Low Rates for Auto Loans. With great rates and up to. Still paying high interest rates on your credit cards? Consolidating your credit card debt can help save you money every month with fixed rates and a known. Now, make all your loan and credit card payments through one simple, yet effective solution. It's time to eliminate all your hassles as you cut down on your. What is a loan buyout? ; If you have an existing loan with another local bank or financial institution, you may be eligible to take a new loan that will be used. Buy out loan is require once your respective bank is not able to fulfil your requirement or you want to combine multiple loans into one package. You may get the. Credit Card. Debit Card. Loan on Card. Credit Card. visa solitaire Solitaire; NEO loan to fund the down payment of the property purchase. Do I need to. Access your credit card line. Investing and retirement. Return to Investing Lease buyout. Vehicle loans /. Auto loans /. Lease servicing. Lease buyout. SCCU debit and credit card holders may withdraw up to $ per day. For a full list of SCCU ATM and branch locations, please visit our locations page. If your lease is coming to an end, but you're reluctant to lose a car you love, a lease buyout is an option. Find out if it's right for you. If you love your leased vehicle, a lease buyout from Ocean Financial will keep you in its driver's seat! When it's right, the time is right now. Apply buyout loan in UAE to Consolidate all Loans & Credit Cards into one Installment. Min. Salary requirement is AED Interest rate starting %.