web-phoenix.ru

Prices

How To Save Home Electricity Bill

Tips for Saving on Your Electric Bill · Turn Down Your Thermostat. It's one of the most effective ways to cut your energy usage. · Take Care of Your Furnace. Look into a Home Improvement Program: Our first recommendation is to look into a Home Improvement Program. · Research your current Heating/Cooling system. Save energy by turning off lights and appliances when you leave a room. · Use compact fluorescent lamp (CFL) bulbs. · Your home computer can use a considerable. Electrical Tips · 1. Reduce Lighting Usage · 2. Invest In Energy Saving Devices ; HVAC Tips · 4. Manage Heating and Cooling · 5. Improve Air Circulation ; Appliances. Another option is to get a smart thermostat, which can be used to adjust the temperature whenever you're not at home. It turns out that when you're using your. By using ceiling fans year-round, you can maintain a comfortable temperature in your home while lowering your reliance on more energy-intensive heating and. Top 10 Energy Saving Tips · 1. Adjust Your Thermostat · 2. Refresh Your Air Filter · 3. Be a Fan of Your Fan · 4. Use Hot Water Wisely · 5. Limit the time you run. Use your air conditioner wisely. Maintain it properly. 2. Use energy efficient light bulbs. 3. Make sure your home has proper insulation. 4. Cut down on. Energy Saving Tips for Your Home Replacing older, inefficient appliances with ENERGY STAR® appliances will save energy and help to lower your bill. Tips for Saving on Your Electric Bill · Turn Down Your Thermostat. It's one of the most effective ways to cut your energy usage. · Take Care of Your Furnace. Look into a Home Improvement Program: Our first recommendation is to look into a Home Improvement Program. · Research your current Heating/Cooling system. Save energy by turning off lights and appliances when you leave a room. · Use compact fluorescent lamp (CFL) bulbs. · Your home computer can use a considerable. Electrical Tips · 1. Reduce Lighting Usage · 2. Invest In Energy Saving Devices ; HVAC Tips · 4. Manage Heating and Cooling · 5. Improve Air Circulation ; Appliances. Another option is to get a smart thermostat, which can be used to adjust the temperature whenever you're not at home. It turns out that when you're using your. By using ceiling fans year-round, you can maintain a comfortable temperature in your home while lowering your reliance on more energy-intensive heating and. Top 10 Energy Saving Tips · 1. Adjust Your Thermostat · 2. Refresh Your Air Filter · 3. Be a Fan of Your Fan · 4. Use Hot Water Wisely · 5. Limit the time you run. Use your air conditioner wisely. Maintain it properly. 2. Use energy efficient light bulbs. 3. Make sure your home has proper insulation. 4. Cut down on. Energy Saving Tips for Your Home Replacing older, inefficient appliances with ENERGY STAR® appliances will save energy and help to lower your bill.

1. Optimize ventilation in your home · 2. Install energy-efficient window treatments · 3. Turn off the heat or AC when you are away · 4. Use cold water whenever. Keep air vents open and unobstructed. Cost to make this change: $0. Your HVAC system is built to provide the proper amount of heating and cooling for a home. On average, heating and cooling your home accounts for 48% of your electric consumption! Consider installing a programmable thermostat in your home. According. The key is to change your everyday habits and invest in energy efficiency. Here are a number of home energy saving tips for ways to lower your electric bill. Check out these low to no-cost tips that both renters and homeowners can follow to save on their energy bill throughout the year. 5 Steps to Save on Utilities ; Energy-efficient lightbulbs · LED lighting · Solar panels ; Buy an energy-efficient water heater · Use less hot water · Repair any. Learn 15 Things That Will Empower You To Save Money ; TIp 9 windows. Windows account for 10%% of your energy bill. During the summer your air conditioner must. Energy-saving tips · Appliance tips. The cost to run your household appliances is a large enough part of your energy budget that taking steps to use less can. Clear your Vents - An energy efficient home requires full ventilation in order to properly work right. Moving all potentially blocking objects from in front of. To save money on cooling costs turn the thermostat to 80 degrees or higher when you are sleeping or away from home. Raising the temperature by five degrees for. 14 ways to save on your electric bill · 1. Schedule an energy audit · 2. Use smart plugs and power strips · 3. Install a smart thermostat · 4. Ask about discounted. 1. Do An Electricity Audit: Basically, this audit just means that you're looking over the electric usage in your home. · 2. Check For Air Leaks. Here is what I have done: Replaced furnace with more efficient model. Wash clothes in cold water. Replaced all windows in the house. Adjust the. Raise your thermostat's temperature While you're at home, set your thermostat to a high (but comfortable) temperature to keep you cool. When you leave or if. Reduce your “always-on” appliances. If your home has a smart meter and you can see your hourly consumption, then examine your consumption at 3AM. It should be. Using a power strip can save you big money when it comes to electricity bills. Turn off the power strip when you're not using those items attached to it. In. Run appliances during off-hours. · Keep shades, blinds, and curtains drawn. · Make Your Refrigerator Run More Efficiently. · Switch off unneeded lights. · Use your. Homeowners · Install a smart thermostat that automatically adjusts when you're home or away · Make sure all spaces are properly insulated · Plant trees/large. 1. Use a programmable thermostat · 2. Extra-insulate your home · 3. Wear comfortable clothing · 4. Replace your air filter · 5. Lower the temperature on the water.

Most Effective Tens Unit

Does TENS work? There's not enough good-quality scientific evidence to say for sure whether TENS is a reliable method of pain relief. More research is needed. We offer the best in Electric Muscle Stimulators (EMS), Electrodes, and EMS Accessories. Electrostimulation allows you to naturally reap the benefits of. Pharmacists ranked the best TENS unit brands for home use and purchased without a prescription. Omron is their No.1 brand. NATURAL PAIN RELIEF WITH MUSCLE STIMULATION: Natural, drug-free and highly effective TENS UNIT for pain relief with muscle stimulation effect. Pain relief can occur at various frequencies. Acute pain is usually most effective between 80 and Hz. Chronic pain can also benefit from lower settings 2 to. Unlike other chronic pain treatments, TENs devices are most effective when engaging in activities like walking, doing housework, or exercising. Research has not proven that it works, but it seems to relieve pain during use. It may help treat period pain, arthritis, fibromyalgia, and other types of pain. Shop for 4 - 5 Stars TENS Units in Pain management at Walmart and save. The Premium TENS UNIT Unit is the best machine for fast, effective and safe pain relief! Designed to give you more precise pain-relieving therapy sessions. Does TENS work? There's not enough good-quality scientific evidence to say for sure whether TENS is a reliable method of pain relief. More research is needed. We offer the best in Electric Muscle Stimulators (EMS), Electrodes, and EMS Accessories. Electrostimulation allows you to naturally reap the benefits of. Pharmacists ranked the best TENS unit brands for home use and purchased without a prescription. Omron is their No.1 brand. NATURAL PAIN RELIEF WITH MUSCLE STIMULATION: Natural, drug-free and highly effective TENS UNIT for pain relief with muscle stimulation effect. Pain relief can occur at various frequencies. Acute pain is usually most effective between 80 and Hz. Chronic pain can also benefit from lower settings 2 to. Unlike other chronic pain treatments, TENs devices are most effective when engaging in activities like walking, doing housework, or exercising. Research has not proven that it works, but it seems to relieve pain during use. It may help treat period pain, arthritis, fibromyalgia, and other types of pain. Shop for 4 - 5 Stars TENS Units in Pain management at Walmart and save. The Premium TENS UNIT Unit is the best machine for fast, effective and safe pain relief! Designed to give you more precise pain-relieving therapy sessions.

The InTENSity 10 Digital TENS Unit is one of the most popular stimulating units in the InTENSity premium digital device family. This device comes equipped. Effective, drug-free muscle and joint pain relief, in a convenient system. Try the new ET Therapeutic Wearable System, a TENS EMS Muscle Stimulator. For neck pain, place two electrodes on the lower backside of the neck on the sides (painful area). For some, placing two or more electrodes above or beside the. This dual-channel, three-mode analog TENS therapy unit (#DT) by Roscoe Medical (aka Richmar / Compass Health Brands) is designed to provide powerful and. A TENS unit uses a mild electrical current to reduce pain. Providers use this therapy to treat conditions like osteoarthritis, tendinitis and fibromyalgia. Best Seller Products · Unimed Pro X - High End, The Most Advanced TENS Unit Muscle Stimulator Rechargeable Pain Reliever Device · Unimed Torque Percussion. Best Pain Relief Device Many people find that TENS units are great options to help relieve back pain or strained muscles. The muscle stimulation that is. Another great TENS unit for pain relief, this one also includes EMS for muscle stimulation/strengthening as well as a "massage" setting for increased. Take back your life with TENS , the top choice for pain sufferers and healthcare professionals. Since , we've helped over 2 million people relieve pain. Arthritis Pain Relief, Improve Mobility, Improve Joint Stiffness ; Med-Fit 1 - Dual Channel Tens Machine. 18 reviews · £ ; Med-Fit 3 Digital Dual Channel TENS. TENS units may help treat pain by sending small electrical impulses through the nervous system. Here we look at seven of the best units online. Shop Best Buy for muscle stimulators. Relieve multiple sources of pain in your body with a TENS unit. Browse our selection to find the. Delivers the same clinical pain relief as our #1 selling TENS unit. Our original TENS machine is notorious for its powerful output. We took what everyone. There is a wide variety of affordable options on the market these days, and our guide can help you find the best TENS unit for you. The older style analog ones are the simplest to use and work very well. This one does not require a prescription and is the one I recommend most often. We'll walk you through some of the most important features and benefits to consider when shopping, and then recommend a few of the most popular models from our. The TENS ™ 2nd Edition is one of the most popular, and best valued, digital TENS units on the market. This Digital TENS unit is a big improvement over. Best TENS Unit On Amazon | AVCOO Tens Review web-phoenix.ru -- Get the AVCOO Tens Unit Here The AVCOO Tens is a massage device. Our proprietary 4D stretch compression and our TENS device are here to help you perform at your best. Feel Better Now! Whether you've been working hard on. Portable dual channel, three-mode analog TENS therapy unit · Experience relief from acute or chronic pain · Great for use on back, foot, shoulder and neck · Treat.

Overdraft Protection From

Overdraft coverage means your debits and payments may be covered even if there isn't enough money in your account. We can cover your overdrafts in three different ways. This notice explains our standard overdraft practices as well as Advantage Overdraft. Overdraft protection typically allows transactions exceeding the balance in your checking account to be approved and can save you steep overdraft fees. An overdraft occurs when there isn't enough money in your personal checking account to cover a payment or purchase. Our convenient overdraft transfer service transfers available funds from your savings account to your checking account if you should overdraw your checking. Money can be automatically transferred from a linked savings account, money market account, personal credit line, or Voice Credit Card® to cover overdrafts and. What is overdraft protection? Overdraft protection provides coverage when transactions exceed the Available Balance in your account. Overdraft protection may help save you from paying overdraft and insufficient fund fees and ensure transactions are carried out as planned. The service is. With TD Bank Overdraft Protection and Services, no fees for overdrawing up to $50, Savings Overdraft Protection, more time with our Grace Period, and more. Overdraft coverage means your debits and payments may be covered even if there isn't enough money in your account. We can cover your overdrafts in three different ways. This notice explains our standard overdraft practices as well as Advantage Overdraft. Overdraft protection typically allows transactions exceeding the balance in your checking account to be approved and can save you steep overdraft fees. An overdraft occurs when there isn't enough money in your personal checking account to cover a payment or purchase. Our convenient overdraft transfer service transfers available funds from your savings account to your checking account if you should overdraw your checking. Money can be automatically transferred from a linked savings account, money market account, personal credit line, or Voice Credit Card® to cover overdrafts and. What is overdraft protection? Overdraft protection provides coverage when transactions exceed the Available Balance in your account. Overdraft protection may help save you from paying overdraft and insufficient fund fees and ensure transactions are carried out as planned. The service is. With TD Bank Overdraft Protection and Services, no fees for overdrawing up to $50, Savings Overdraft Protection, more time with our Grace Period, and more.

Balance Connect for overdraft protection is an optional service which allows you to link your eligible checking account to up to 5 other Bank of America. The bank must notify you in writing or electronically about the bank's overdraft service and obtain your affirmative consent to participate. If you had. Our Overdraft Protection Plans help prevent overdrafts by automatically transferring funds to your checking account from another Bank Midwest account or a line. Our convenient overdraft transfer service transfers available funds from your savings account to your checking account if you should overdraw your checking. Overdraft Protection covers all transaction types – including, for example, ATM and debit card transactions, checks, Bill Pay, and recurring electronic payments. You can avoid being overdrawn in your checking account by signing up for Overdraft Protection. If your account does not have funds to cover items, this service. Effective June 1, , Cape Cod 5 no longer charges fees associated with overdrawing an account. As a trusted financial partner, we are committed to. A transaction that exceeds your Available Balance will cause your account to become overdrawn and a $35 overdraft fee will apply. Lubbock National Bank offers three overdraft solutions to assist you in managing your account while allowing you to control your cost. Understanding Overdraft Protection · Overdraft Privilege - DCCU pays the item for you, taking your account negative, you must bring balance back to $0 or. If you do opt-in for overdraft protection or coverage, then your bank may pay a debit card purchase or ATM transaction, even if the transaction overdraws your. With Overdraft Protection, you can protect yourself from the inconvenience of declined transactions or returned (bounced) checks. Regions Overdraft Protection may be used to pay checks, ACH transactions, and other items when payment of those items would overdraw the checking account. Set up Overdraft Protection to link your checking account with up to two other eligible PNC accounts (called your Protecting Accounts) so that you can use. Whether you forgot to record a transaction or a deposit didn't clear in time, overdrafts can happen. Pathfinder Bank's Discretionary Extended Overdraft. With overdraft protection, checks and other debit transactions still clear when there are insufficient funds, but this service comes at a price. You can protect yourself from unexpected overdrafts by enrolling in Overdraft Protection, which enables automatic transfers to your checking account. Central Pacific Bank offers the following overdraft protection options for your personal checking account for those occasional overdrafts. Many banks provide some form of overdraft service as a standard practice so that your checks do not bounce and your electronic bill-pay transactions go through. We provide several options to help you prevent or manage fees and provide you with peace of mind that your transactions will clear.

Southern Co Stock Price Today

-stock-chart-5-years.png)

The Southern Company's stock symbol is SO and currently trades under NYSE. It's current price per share is approximately $ What are your The Southern. ATLANTA, Aug. 1, /PRNewswire/ -- Southern Company today reported second-quarter earnings of $ billion, or $ per share, in compared with. Southern Co SO:NYSE · Open · Day High · Day Low · Prev Close · 52 Week High · 52 Week High Date08/05/24 · 52 Week Low · 52 Week. The Southern Co is a holding company, which engages in the generation and sale of electricity. It operates through the following segments. How much is Southern Co's stock price per share? (NYSE: SO) Southern Co stock price per share is $ today (as of Aug 28, ). · What is Southern Co's. Southern Company (The) ; 52wk High. ; Volume. 1, ; Beta. ; PE Ratio. ; EPS. NYSE: SO ; Price. $ Volume. 1,, ; Change. + % Change. +% ; Today's Open. $ Previous Close. $ Southern is one of the largest utilities in the US. The company serves 9 million customers with vertically integrated electric utilities in three states. Key Data Points. Current Price. The most recent price per share for this stock. $ Daily Change. The percentage change for this company's share price today. The Southern Company's stock symbol is SO and currently trades under NYSE. It's current price per share is approximately $ What are your The Southern. ATLANTA, Aug. 1, /PRNewswire/ -- Southern Company today reported second-quarter earnings of $ billion, or $ per share, in compared with. Southern Co SO:NYSE · Open · Day High · Day Low · Prev Close · 52 Week High · 52 Week High Date08/05/24 · 52 Week Low · 52 Week. The Southern Co is a holding company, which engages in the generation and sale of electricity. It operates through the following segments. How much is Southern Co's stock price per share? (NYSE: SO) Southern Co stock price per share is $ today (as of Aug 28, ). · What is Southern Co's. Southern Company (The) ; 52wk High. ; Volume. 1, ; Beta. ; PE Ratio. ; EPS. NYSE: SO ; Price. $ Volume. 1,, ; Change. + % Change. +% ; Today's Open. $ Previous Close. $ Southern is one of the largest utilities in the US. The company serves 9 million customers with vertically integrated electric utilities in three states. Key Data Points. Current Price. The most recent price per share for this stock. $ Daily Change. The percentage change for this company's share price today.

; Volume: M · 65 Day Avg: M ; Day Range ; 52 Week Range

Previous Close ; Week High/Low ; Volume 1,, ; Average Volume 4,, ; Price/Earnings (TTM) CMS Energy Corporation, ; CenterPoint Energy, ; Dominion Resources, ; DTE Energy, Previous Close ; Week High/Low ; Volume 1,, ; Average Volume 4,, ; Price/Earnings (TTM) Southern Company stocks price quote with latest real-time prices, charts Live educational sessions using site features to explore today's markets. Key Data ; Exchange. NYSE ; Sector. Utilities ; Industry. Electric Utilities: Central ; 1 Year Target. $ ; Today's High/Low. $/$ On Thursday, Southern Co (SO:NYQ) closed at , % below its week high of , set on Aug 05, week range. Today. Oct 03 Southern Company (web-phoenix.ru): Stock quote, stock chart, quotes, analysis, advice, financials and news for Stock Southern Company | Nyse: SO | Nyse. After Hours Vol. K. Delayed quote. Price at close. $ %. Historical daily share price chart and data for Southern since adjusted for splits and dividends. The latest closing stock price for Southern as of. NYSE:SO,NYSE:SO historical stock data. Stock Date, Stock Price. August 28, , $ August 27, , $ August 26, , $ Southern Co. · AT CLOSE PM EDT 08/27/24 · USD · % · Volume3,, On Friday 08/30/ the closing price of the Southern Co. share was $ on BTT. Compared to the opening price on Friday 08/30/ on BTT of $, this. Southern Co. historical stock charts and prices, analyst ratings, financials, and today's real-time SO stock price. Southern Co.'s market capitalization is $ B by B shares outstanding. Is Southern stock a Buy, Sell or Hold? Southern Company (SO) · What Is the Southern Company Stock Price Today? The Southern Company stock price today is · What Is the Stock Symbol for Southern. Georgia Natural Gas® announced today that its Greener Life® program, which helps customers make their natural gas usage carbon neutral, has reached a new. Southern Company (The) Common Stock (SO) Historical Quotes. 1M 6M YTD 1Y 5Y MAX. Download historical data. Get Southern Co (SO) real-time stock quotes, news, price and financial Today's Range: - 52 Week Range: - Profile · Charts. Key facts today B of A Securities has maintained a Neutral rating on Southern Company and raised its price target to $ per share from $ Analyze the. Southern Co. Share Price Live Today:Get the Live stock price of SO Inc., and quote, performance, latest news to help you with stock trading and investing.

How Much Ameritrade Charge Per Trade

No-Transaction-Fee (NTF) mutual funds are no-load mutual funds for which. TD Ameritrade does not charge a transaction fee. Per-Transaction Fee: $ Schwab charges $25 per broker-assisted trade. Note that Fidelity also charges a short-term redemption fee for no-transaction-fee mutual funds in its. Options cost $ per contract and TD Ameritrade charges % on margin Between the two platforms, TD Ameritrade provides the more complete trading. This fee is in addition to any applicable transaction fees or fees described in the fund's prospectus. Getting started. How do I open a TD Ameritrade. SDBA? To. Stocks, ETFs, and closed-end funds now cost $0 per trade. Options have no base charge; although there is a 65¢ fee per contract. Futures cost $ per side. $ premium above the Domestic. Online rates referenced above. Trade Here Settle Anywhere Orders (DVP Accounts). Domestic. $ per share. TD Ameritrade charges $ for trading stocks, ETFs, Mutual Funds and option trades. The standard options contract fee is $ per contract (or $ per contract for clients who execute at least 30 stock, ETF, and options trades per quarter). Like competitors, TD Ameritrade offers commission-free stock and ETF trading. There are no minimum investments or account fees. No-transaction-fee and zero-. No-Transaction-Fee (NTF) mutual funds are no-load mutual funds for which. TD Ameritrade does not charge a transaction fee. Per-Transaction Fee: $ Schwab charges $25 per broker-assisted trade. Note that Fidelity also charges a short-term redemption fee for no-transaction-fee mutual funds in its. Options cost $ per contract and TD Ameritrade charges % on margin Between the two platforms, TD Ameritrade provides the more complete trading. This fee is in addition to any applicable transaction fees or fees described in the fund's prospectus. Getting started. How do I open a TD Ameritrade. SDBA? To. Stocks, ETFs, and closed-end funds now cost $0 per trade. Options have no base charge; although there is a 65¢ fee per contract. Futures cost $ per side. $ premium above the Domestic. Online rates referenced above. Trade Here Settle Anywhere Orders (DVP Accounts). Domestic. $ per share. TD Ameritrade charges $ for trading stocks, ETFs, Mutual Funds and option trades. The standard options contract fee is $ per contract (or $ per contract for clients who execute at least 30 stock, ETF, and options trades per quarter). Like competitors, TD Ameritrade offers commission-free stock and ETF trading. There are no minimum investments or account fees. No-transaction-fee and zero-.

How TD Ameritrade makes money TD Ameritrade charges $ commission for stock, ETF, and options trades, but they do charge $ contract fee. They offer. Mutual Funds ; Mutual fund trades (Greater than $1 per share), $ ; Broker assisted trades, No extra charge. Trading fees and account types. Schwab charges $0 for stock and ETF trades and $ per contract for options. You could find cheaper options commissions if you. Commission and Fees · You'll be charged a $ fee if you want to trade securities that aren't listed on major exchanges · Options are $ per contract · Full. $0 online equity trade commissions + Satisfaction Guarantee. We clearly explain the fees we charge, and we'll always be committed to giving you transparent. It now has no charges on Equity and ETF trades, in line with the introduction of commission-free trading within the industry last year, but on the downside, it. Why do I have delayed Stock and Option Market Data? How long is the delay on delayed data charts and quotes? When would my account show day trading buying power. How We Compare ; Broker Assisted Trade. $0. $25 ; Options ; Capped Options Commission. - ; 25 Put/Calls (50 Total Contracts). $ · $ If you are trading options, TDAmeritrade charges US$ per contract with no ticket charges, exercise, or assignment fees. Otherwise, TDAmeritrade charges US. They offer $0 online equity and ETF trades, along with $0 options trades. However, they do charge a per-contract fee for options trades, which. Trading Fees and Commissions · $0. Listed Stocks and ETFs. online commission · $0. Options. online base commission + $ per contract fee · $0. Mutual Funds. on. There is no per-transaction charge. Please ensure there are sufficient funds in your TD Ameritrade account to make the systematic purchase. Options. Equity or. However, there is a $5 charge per executed order plus $ charged for each contract traded in options trading. For margin rates, TD Ameritrade splits it up. The fees is low at only $ per trade. I want to switch over. But that is not able to allow me to do fractional shares which is what i trade most of the. ThinkorSwim option fees are $0 commissions per trade, plus an additional of $ per options contract Ameritrade if you don't want to trade ThinkorSwim. Pricing · How you trade. Online Commissions Standard Rate Flat fee online commission rates. Canadian & U.S. Stocks · Commission-free investments · Mutual Funds No. Non-Standard Asset Transaction Fee: $ per transaction. Employee Stock Option Plans (ESOP). No charge. Non-TD Ameritrade fees may apply. Restricted Stock. No. See How We Compare ; Company, TRADE, %, % ; TD Ameritrade, %, %. TD Ameritrade receives a fee from the IDA Program Banks that ranges from to %. TD Ameritrade has the right to waive all or part of this fee. $ commission applies to online U.S. equity trades, exchange-traded funds (ETFs), and options (+ $ per contract fee) in a Fidelity retail account only.

Can You Negotiate With Car Dealers

How much can you negotiate on a used car? It often comes down to the individual seller, the vehicle's condition, and the impression you make. A good rule of. This means you are usually unable to negotiate the price of a no-haggle vehicle. You may, however, be able to find exceptions at local dealerships with less. Can you ask a car dealer to lower the price? Yes, you can negotiate on the price of a car. However, it helps to do your research on the vehicle's fair. How much can you negotiate on a used car? There isn't a set amount that you can negotiate a used car for. Each used vehicle is different in one way or another. If you want to negotiate a price you need cash or good credit. Most likely a high-end dealership, they're only going to negotiate so much. No-haggle car buying is a car sales method that offers buyers an upfront price that won't change when they come into the dealership. Never negotiate at the dealer. Research the vehicle. Calculate a discount based on market data and include the factory holdback. Add in tax and plate fees. If you don't want to haggle over the price, you may buy a car from a one-price dealer or hire an auto broker to negotiate a deal for you. But if you're among. You should always haggle when buying a new or used car to make sure you're getting the best price. What's in this guide. How to haggle for a new car; Top tips. How much can you negotiate on a used car? It often comes down to the individual seller, the vehicle's condition, and the impression you make. A good rule of. This means you are usually unable to negotiate the price of a no-haggle vehicle. You may, however, be able to find exceptions at local dealerships with less. Can you ask a car dealer to lower the price? Yes, you can negotiate on the price of a car. However, it helps to do your research on the vehicle's fair. How much can you negotiate on a used car? There isn't a set amount that you can negotiate a used car for. Each used vehicle is different in one way or another. If you want to negotiate a price you need cash or good credit. Most likely a high-end dealership, they're only going to negotiate so much. No-haggle car buying is a car sales method that offers buyers an upfront price that won't change when they come into the dealership. Never negotiate at the dealer. Research the vehicle. Calculate a discount based on market data and include the factory holdback. Add in tax and plate fees. If you don't want to haggle over the price, you may buy a car from a one-price dealer or hire an auto broker to negotiate a deal for you. But if you're among. You should always haggle when buying a new or used car to make sure you're getting the best price. What's in this guide. How to haggle for a new car; Top tips.

The “S” in MSRP stands for suggested, and most dealers are willing to bargain on their profit margin. Negotiate the total purchase price rather than the monthly. After a deal is agreed upon and the contract signed, if you are contacted by the dealer saying they now need a larger down payment, a higher monthly payments. A dealership's first offer is unlikely to be the best one you'll receive. Even if a car dealer pressures you immediately, they are often willing to negotiate. "Dealers will absolutely try to get you to negotiate monthly payments instead of purchase price, because we make more money if we do it that way," says Bill. Car prices are always negotiable, unless the dealer has a fixed-price policy, such as at Carmax. However, local supply-and-demand will dictate. You can also negotiate the price they're willing to give you for your trade-in and dealer fees such as dealer prep, documentation fees, advertising charges and. According to CNN, salespeople are trained to negotiate down based on the car's MSRP, which is what they'd like to get for the vehicle. Instead, negotiate up. Haggling: Don't hesitate to negotiate with multiple dealers and use their prices as leverage. After visiting a few dealerships, feel free to revisit the. Three tips for shopping for your next new car While Used vehicles at all Herb Chambers Dealerships are individaully smart priced so there is no need for. Dealer incentives (also commonly referred to as factory incentives) are put in place by the manufacturer and allow for greater price flexibility because they. The short answer: yes but it depends. You have to know how to negotiate used car prices, know what to research and understand exactly how much the listed price. The best way to avoid most scams is to negotiate each aspect of your transaction seperately, and don't ever negotiate at the dealership. Use phone and email. Here are some top tips on how to haggle with a used car dealer. Do your research beforehand. Researching before purchasing a used car will always work in your. If you don't want to haggle over the price, you may buy a car from a one-price dealer or hire an auto broker to negotiate a deal for you. But if you're among. Researching your needs versus your budget will help the negotiation process, as the dealer will guide you to the car that is right for you. Typically, these are fees the dealer doesn't negotiate but that doesn't mean you shouldn't consider that in your decision making. Most dealerships do not show. Successful negotiations with your car dealer can lower the overall price of a vehicle, reduce your monthly payment, and even help you score add-ons and extras. Signing a buyer's order or placing a deposit should NOT be done during negotiations Be especially wary if the dealership tells you that all their cars must. It's unlikely you'll ever get a dealer to bargain all the way down to their holdback price, since they need to make a profit to stay in business. Just be aware. It's unlikely you'll ever get a dealer to bargain all the way down to their holdback price, since they need to make a profit to stay in business. Just be aware.

How To Double 1000 Dollars Fast

Applying the rule of 72, the number of years to double your money is 72 divided by the annual interest rate in percentage. If $1, is borrowed at 8. At $24 per hour, you could potentially earn $ a week on just over 8 hours a day. The Best Side Hustles You Need to Know: 8 Ways to Make Extra Money with. For example, if the expected annual return of a bank Certificate of Deposit (CD) is % and you have $1, to invest, it will take 72/ or years for. The more frequently the interest on the account compounds, the faster your money grows. double at a specific interest rate. It's not as accurate as. If you were to start with one dollar and double it each day for a month, the final amount would be a staggering sum. The exponential growth showcases the. The S RR has now been made even sharper and more precisely geared towards pure performance on race tracks or country roads. For everyone demanding the. If it takes nine years to double a $1, investment, then the investment will grow to $2, in year 9, $4, in year 18, $8, in year 27, and so on. $1, on eBay. If you're able to flip a handful of cameras per month, you can easily earn a couple hundred dollars or more. And if your local thrift stores. fast benchmark to determine how good (or not so good) a potential investment is likely to be. The rule says that to find the number of years required to double. Applying the rule of 72, the number of years to double your money is 72 divided by the annual interest rate in percentage. If $1, is borrowed at 8. At $24 per hour, you could potentially earn $ a week on just over 8 hours a day. The Best Side Hustles You Need to Know: 8 Ways to Make Extra Money with. For example, if the expected annual return of a bank Certificate of Deposit (CD) is % and you have $1, to invest, it will take 72/ or years for. The more frequently the interest on the account compounds, the faster your money grows. double at a specific interest rate. It's not as accurate as. If you were to start with one dollar and double it each day for a month, the final amount would be a staggering sum. The exponential growth showcases the. The S RR has now been made even sharper and more precisely geared towards pure performance on race tracks or country roads. For everyone demanding the. If it takes nine years to double a $1, investment, then the investment will grow to $2, in year 9, $4, in year 18, $8, in year 27, and so on. $1, on eBay. If you're able to flip a handful of cameras per month, you can easily earn a couple hundred dollars or more. And if your local thrift stores. fast benchmark to determine how good (or not so good) a potential investment is likely to be. The rule says that to find the number of years required to double.

Double-tap to zoom. Audiobook $ for membership Try again. Amazon prime logo. Unlock fast, free delivery on millions of Prime eligible items. of every dollar you sell supports your cause. You keep half of what you sell through the Double Good app, so you reach your goal faster. And there are no set. Here's how much money you'd have if you invested $1, in the S&P a decade ago. Published Fri, Apr 21 PM EDT Updated Fri, Apr 21 PM. I am a fast food restaurant employee, and a collector is attempting to garnish my wages-that is, get the money from my paycheck before I receive it. I. It's an easy way to calculate just how long it's going to take for your money to double. Just take the number 72 and divide it by the interest rate you hope to. But by decreasing my spending to $3, I was able to reach the crossover point faster. To say that another way, the higher your expenses the more money you'll. Best Chance Ever To Win $1, Tax Free! How To Play. BONUS: Reveal a MONEY symbol in any of the BONUS spots and win the prize shown for that BONUS spot. The truth is, you do not need a lot to start investing. You don't need thousands of dollars; it can be just $1, If you have a full-time job and do not. FINES DOUBLE for violation of any of the following sections if violated in an active work zone manned by workers acting in their official capacity: PaVC Sec. So how do you generate $1,'s in passive income with just a $ investment? Sign up with Bluehost; Pick a domain name; Build your website; Create content. How to Invest Dollars [And Grow it to $10, Fast] · 1. Rental Homes · 2. Individual Stocks · 3. HYSA · 4. P2P Lending · 5. HSA · 6. ETFs · 7. Pay off High-. The best way to double 20k is to start a business or invest in something that will earn you money right away. 1) Invest in real estate. The first. The fast track to the free stuff. · Enjoy award travel on the double. · Earn points up, down & all around. · Use your points whenever, wherever. · Get going sooner. We'll show you tips that will help you make money fast, sometimes in as little as one day! double the price you paid for them. When considering the. Unclaimed Prizes ; $, , CASH TIME! ; $, , FAST BUCKS ; $, , TRIPLE MATCH ; $, , DOUBLE IT! Figure out what interest rate you need for an investment to double in a set number of years. For prizes over $, please see how to claim a prize. Prize, Odds. % of Jackpot + $, DOUBLE W!N. DOUBLE W!N. DETAILS. Price: $5. Top Prize: 50% of. money into more money. We have listed our top kasi business ideas that can help you make money fast in South Africa. Above all else, remember it's. Daily Compounding · Start with $1, at 1% compounded daily. · At the end of the first day, you have $1, · On the second day, add the interest earned. Total expenditures for public elementary and secondary schools in the United States were $ billion in –21 (in constant –23 dollars).

Lowest Fha Loan Rates

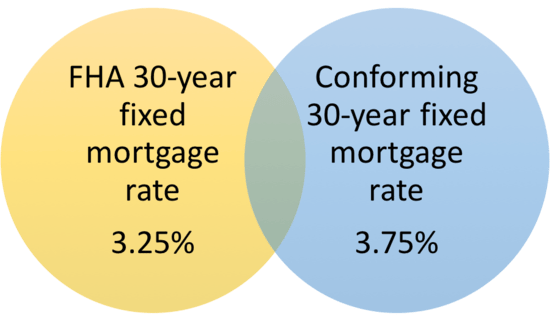

Mortgage rates stay under %. Mortgage rates stabilized this week, averaging % for year fixed loans, according to Bankrate's lender survey. Thirty-year. Current APR on year FHA loans is %, making it a good option for those looking to refinance to a shorter repayment period. Bank of America — Best for. National year fixed FHA mortgage rates remain stable at % The current average year fixed FHA mortgage rate remained stable at % on Monday, Zillow. year FHA loans: % with point (previous week: % with point). Mortgage Rate Trends, Past 3 Months. YR Fixed, FHA loan borrowers are insured up to % financing on a home's value, with as low as % down. This is granted provided borrowers meet particular mortgage. How does an FHA Loan compare to other Elements mortgage options? On Tuesday, September 10, , the average APR on a year fixed-rate mortgage remained at %. The average APR on a year fixed-rate mortgage remained. With a down payment as low as % and lower credit score requirements, an FHA loan makes it easier to reach your homeownership goals. Graphic card image with. Low down payments: Depending upon your credit score, your down payment may be as low as % of the loan amount. · Less stringent down payment rules: % of the. Mortgage rates stay under %. Mortgage rates stabilized this week, averaging % for year fixed loans, according to Bankrate's lender survey. Thirty-year. Current APR on year FHA loans is %, making it a good option for those looking to refinance to a shorter repayment period. Bank of America — Best for. National year fixed FHA mortgage rates remain stable at % The current average year fixed FHA mortgage rate remained stable at % on Monday, Zillow. year FHA loans: % with point (previous week: % with point). Mortgage Rate Trends, Past 3 Months. YR Fixed, FHA loan borrowers are insured up to % financing on a home's value, with as low as % down. This is granted provided borrowers meet particular mortgage. How does an FHA Loan compare to other Elements mortgage options? On Tuesday, September 10, , the average APR on a year fixed-rate mortgage remained at %. The average APR on a year fixed-rate mortgage remained. With a down payment as low as % and lower credit score requirements, an FHA loan makes it easier to reach your homeownership goals. Graphic card image with. Low down payments: Depending upon your credit score, your down payment may be as low as % of the loan amount. · Less stringent down payment rules: % of the.

Current FHA mortgage rates are % for a 30 year fixed rate loan and NA for a 15 year fixed loan. The current national average 5-year ARM mortgage rate is down 2 basis points from % to %. Last updated: Saturday, September 7, See legal. Compare our current interest rates ; year fixed, %, % ; FHA loan, %, % ; VA loans, %, % ; Jumbo loans, %, %. They include your loan amount, how much debt you have compared to your income and your credit profile. Our experts use this info to find the best rate for you –. What is the interest rate for a credit score on an FHA loan? Current FHA loan rates for a borrower with a credit score are around %. Rates change. Saving for a down payment on a home can be hard! Our FHA loans may be the best choice for buyers who are tired of renting, purchasing a first home. FHA loans ; Conventional fixed-rate loans · year. %. %. $2, ; Conforming adjustable-rate mortgage (ARM) loans · 10/6 mo. %. %. $2, Current FHA mortgage rates. Average year FHA interest rates were around % in August, according to Zillow data — over a full percentage point below the. VA mortgage with navy Federal is probably the lowest available out of anything. loan (including the interest rate original to the. As of September 10, , a year fixed FHA loan rate in Utah is %(%APR). Use the tool below to customize Utah FHA loan rates for year. Today's FHA Loan Rates ; % · % · Year Fixed · %. Today. The average APR on a year fixed mortgage is %. Last week. %. year fixed-rate. Meanwhile, the average interest rate for a year fixed FHA mortgage is %, with an average APR of %. This data was taken from web-phoenix.ru FHA. Current mortgage rates by loan type ; year fixed rate. %. % ; year fixed rate. %. % ; year fixed rate. %. % ; FHA year fixed. This index includes rate locks from Federal Housing Authority loans. Optimal Blue Mortgage Market Indices™ (OBMMI™) is calculated from actual locked. Compare mortgage rates when you buy a home or refinance your loan. Save money by comparing free, customized mortgage rates from NerdWallet. Today's Interest Rates ; CalHFA FHA · % ; CalPLUS FHA with 2% Zero Interest Program · % ; CalPLUS FHA with 3% Zero Interest Program · N/A ; CalHFA VA · %. Current average mortgage interest rates in the U.S. in September 9, , the average year fixed mortgage rate is %, year fixed mortgage rate is %, year fixed mortgage rate is %, and year fixed. VA mortgage with navy Federal is probably the lowest available out of anything. loan (including the interest rate original to the.

Home Depot Apply For Credit Card

Visit the Home Depot Credit Cards page to pay and manage your card. You apply to texts). Stores|; © Home Depot|; Privacy & Security. This may include applying such payments and credits to lower A P R balances first. Payment Instructions. We credit your payments in accordance with our payment. Manage your Home Depot credit card account online, any time, using any device. Submit an application for a Home Depot credit card now. Current ProPurchase participants may shop at The Home Depot retail stores nationwide, using your HD Supply line of credit. Manage your Home Depot credit card account online, any time, using any device. Password guidelines A secure Password is easy for you to remember, but difficult. Note: Your Home Depot Commercial Credit card must be linked to a PX ID and Purchases that pre-date membership sign up date will not earn rewards. Find answers to general questions about The Home Depot's Credit Center. Get access to finance offers at Home Depot with the Home Depot Credit Card. Plus, pay no annual fee. To apply for a credit card, you will need a Social Security number (in most cases), a physical U.S. address, and a source of income. Applicants under 21 years. Visit the Home Depot Credit Cards page to pay and manage your card. You apply to texts). Stores|; © Home Depot|; Privacy & Security. This may include applying such payments and credits to lower A P R balances first. Payment Instructions. We credit your payments in accordance with our payment. Manage your Home Depot credit card account online, any time, using any device. Submit an application for a Home Depot credit card now. Current ProPurchase participants may shop at The Home Depot retail stores nationwide, using your HD Supply line of credit. Manage your Home Depot credit card account online, any time, using any device. Password guidelines A secure Password is easy for you to remember, but difficult. Note: Your Home Depot Commercial Credit card must be linked to a PX ID and Purchases that pre-date membership sign up date will not earn rewards. Find answers to general questions about The Home Depot's Credit Center. Get access to finance offers at Home Depot with the Home Depot Credit Card. Plus, pay no annual fee. To apply for a credit card, you will need a Social Security number (in most cases), a physical U.S. address, and a source of income. Applicants under 21 years.

Credit Card Services - The Home Depot · Apply Now · Pay and Manage Card · · Card FAQs.

Commercial Credit Cards · Access to exclusive Pro Xtra Loyalty Program benefits when you sign up · No annual fee · Flexible payment options · Easy-to-read, SKU. You can also sign up for a Home Depot account using the app. BARCODE SCANNER. Check prices and inventory from anywhere to make shopping at Home Depot even. If you get approved online, you also get an email with your temporary code if you wanted to apply before even going in. The Home Depot Consumer Credit Card. Overall card rating. Reviews Do not apply for this card and if you have it, destroy it and pay it off. Apply today and discover the benefits your new card has to offer. Enjoy everyday promotional financing on qualifying purchases anywhere the card is accepted. Get 6 months on purchases of $ - $ or 12 months on. You'll need a score or higher to be eligible for a Home Depot credit card. Home Depot Credit Card new account promotion. Can You Save with the Home Depot. To receive The Home Depot Commercial Account, you must meet our credit qualification criteria. Your credit limit will be determined by a review of your credit. Nobody wants a credit card from home depot right now, not while we're actively in a recession and the benefits are ass. Visit the Home Depot credit card website. · Fill in the application form. You will typically need to provide general financial information, such as your Social. You can apply for The Home Depot® Consumer Credit Card by visiting the online application portal and filling out the necessary information. You will be required. Home Depot® Credit Card Requirements: · Credit score requirement: A credit score of + (fair credit). · Age requirement: Must be at least 18 years old. If you are married, you may apply for a separate account. Citibank, N.A. ("we" or "us") is the issuer of your The. Home Depot Consumer Credit Card account. A credit card rejection doesn't mean you'll never get approved. Instead, find out what's blocking the approval and take steps to correct it. I have a Home Depot credit card. How do I check the account balance and activity? Credit Record Needed: Based on the FICO score recommendation, applicants should have a fairly solid or limited credit record, with no recent negative marks on. when you use your Home Depot® Consumer Credit Card from Thursday, August 29 to Wednesday, October 9, , on the purchase of any Furnace, Air Conditioner, Heat. (I suggest going to a regular register, the amount of credit cards we get each week is tracked and any little bit helps). At either place, they. This is a very self-explanatory fine print from another credit card. "You cannot choose how to apply your payments to the Account or to apply. Home Depot® Credit Card Requirements: · Credit score requirement: A credit score of + (fair credit). · Age requirement: Must be at least 18 years old.

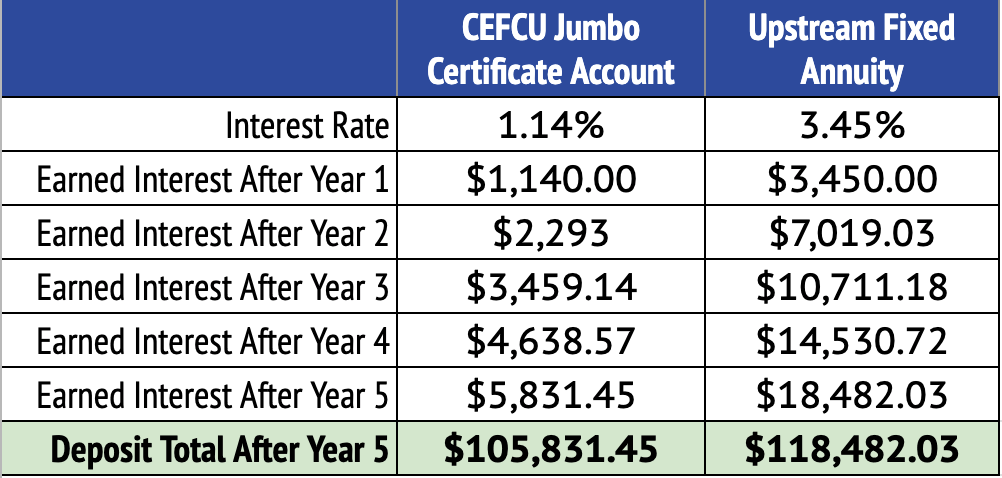

What Is The Interest Rate On A Cd

Today's Standard Fixed Rate CDs ; 3 month · %. % ; 6 month · %. % ; 1 year · %. %. Open an online Capital One CD to earn an interest rate with guaranteed yield. Compare our CD terms and annual yield rates. Enjoy the protection of FDIC. Best CD rates of August (Up to %) · America First Credit Union — 3 months - 5 years, % – % APY, $ minimum deposit · Synchrony Bank — 3 months. With these numbers, calculating interest is straightforward—simply multiply the CD balance by the APY. For example, if you have a $1, CD with a term of three. California Coast Credit Union currently offers a limited-time 5-month Celebration Certificate offering a whopping % APY CD rate. It's one of two credit. CD Specials ; TERM, MINIMUM OPENING BALANCE, RATE ; 8-Month · CD Special», $, %1 APY ; Month · CD Special», $2,, %2 APY. High-yield CD rates today can be several times the national average of % APY for five-year terms and the national average of % APY for one-year terms. Earn up to % APY 1 on a Certificate of Deposit. Explore our wide range of CD account terms that can help you earn more interest. Open an account. Quontic Bank offers five fixed-rate CDs with terms ranging from six months to five years, with its highest APY (%) reserved for its 6-month CD. Its minimum. Today's Standard Fixed Rate CDs ; 3 month · %. % ; 6 month · %. % ; 1 year · %. %. Open an online Capital One CD to earn an interest rate with guaranteed yield. Compare our CD terms and annual yield rates. Enjoy the protection of FDIC. Best CD rates of August (Up to %) · America First Credit Union — 3 months - 5 years, % – % APY, $ minimum deposit · Synchrony Bank — 3 months. With these numbers, calculating interest is straightforward—simply multiply the CD balance by the APY. For example, if you have a $1, CD with a term of three. California Coast Credit Union currently offers a limited-time 5-month Celebration Certificate offering a whopping % APY CD rate. It's one of two credit. CD Specials ; TERM, MINIMUM OPENING BALANCE, RATE ; 8-Month · CD Special», $, %1 APY ; Month · CD Special», $2,, %2 APY. High-yield CD rates today can be several times the national average of % APY for five-year terms and the national average of % APY for one-year terms. Earn up to % APY 1 on a Certificate of Deposit. Explore our wide range of CD account terms that can help you earn more interest. Open an account. Quontic Bank offers five fixed-rate CDs with terms ranging from six months to five years, with its highest APY (%) reserved for its 6-month CD. Its minimum.

The best CD rate is % on a six-month CommunityWide Federal Credit Union CW Certificate Account, but other financial institutions offer similar rates on. Personal CD Rates ; 15 month, %, % ; 18 month, %, % ; 2 year, %, % ; 3 year, %, %. Simple CDs ; 3 Months · %, % ; 6 Months, %, % ; 12 Months, %, % ; 13 Months SPECIAL, %, %. Personal CD Rates ; 15 month, %, % ; 18 month, %, % ; 2 year, %, % ; 3 year, %, %. Today's APY of these Fixed Term CDs is %. Your rate will be determined at maturity. At maturity, Fixed Term CDs renew into Fixed Term CDs of the same term. Interest rates have shot up across the board. Now, the best CD rates hover around 5% APY for terms ranging from six months to a year, but these rates are. Two Year Step-Up CD · month term · % APY* · The minimum opening deposit is $1, · The maximum opening deposit is $1,, · If our rates increase, you can. Like savings accounts, CDs earn compound interest—meaning that periodically, the interest you earn is added to your principal. Then that new total amount earns. Certificate of Deposit (CD) offering a % APY has a term of 6 months and applies the simple interest method, with interest paid at maturity. CD offering a. % APY1 7 Month CD Rate Special · Get a great rate on a CD · How to choose between CDs and IRAs · Find the CD that's right for you · Find the IRA that's right. A CD rate is the interest rate offered on a certificate of deposit account. Financial institutions typically make CD rates higher than the interest rates. FDIC-Insured Certificates of Deposit Rates ; month, N/A ; 3-year, % ; 4-year, % ; 5-year, %. Online Certificate of Deposit (CD) ; 6 Month, %, % ; 12 Month, %, % ; 18 Month, %, % ; 24 Month, %, %. The best CD rates today are above 5% for one-year terms and above 4% for three- to five-year terms. CDs provide a boost to savings, with certain limits: You. Plus, FDIC insurance covers CDs and other First American Bank deposit products. The rates are fixed, so you're certain to maximize your deposit. Use this. Personal Deposit Interest Rates ; 6 Month, %, % ; 7 Month Promo · %, % ; 9 Month, %, % ; 11 Month Promo · %, %. Minimum deposit of $2, required to open and earn stated APY. Interest on CDs longer than 12 months must be paid out at least annually. The annual percentage. The interest rate for the 5 month CD is %. The interest rate remains fixed until maturity. Fees could reduce earnings. A penalty may be imposed for early. Simple CDs ; 3 Months · %, % ; 6 Months, %, % ; 12 Months, %, % ; 13 Months SPECIAL, %, %. Check out our special 9-Month Promo CD with a limited-time rate of % APY. LEARN MORE ABOUT THis GREAT RATE. And be sure to explore all the other options for.